- June 20, 2023

Canadian Federal Budget 2023 Introduces Groundbreaking Clean Investment Tax Credits to Accelerate Sustainable Growth.

Introduction

To help build Canada’s clean economy, Budget 2023 includes numerous measures incentivizing the development of projects related to clean energy and technology. This article summarizes the following five tax incentives included in Budget 2023:

- Clean Electricity Investment Tax Credit (CEI)

- Clean Technology Investment Tax Credit (CT)

- Clean Technology Manufacturing Investment Tax Credit (CTM)

- Clean Hydrogen Investment Tax Credit (CH)

- Carbon Capture, Utilization and Storage Investment Tax Credit (CCUS)

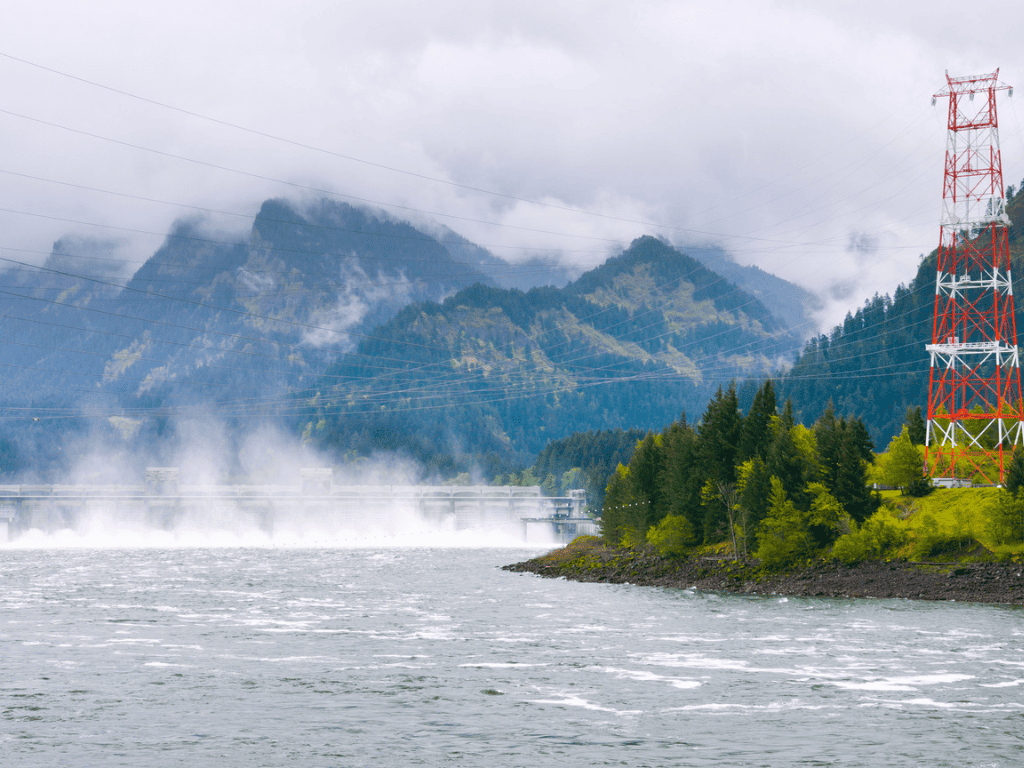

Clean Electricity Investment Tax Credit (CEI)

To support and accelerate the transition to clean electricity in Canada, Budget 2023 introduced a new 15% refundable Clean Electricity Investment Tax Credit for eligible investments in technologies that are required for the generation and storage of clean electricity and its transmission between provinces and territories. The credit can be used for eligible expenses related to the development of new projects as well as the refurbishment of existing facilities.

It appears there will be a significant overlap between equipment eligible for the Clean Technology (CTI) Tax Credit and the CEI Tax Credit. However, Budget 2023 states that both taxable and non-taxable entities may claim the CEI Tax Credit. This significantly differentiates this credit from the CTI Tax Credit.

Eligible investments include:

- Non-emitting electricity generation systems: wind, concentrated solar, solar photovoltaic, hydro (including large-scale), wave, tidal and nuclear (including large-scale and small modular reactors).

- Abated natural gas-fired electricity generation (subject to an emissions intensity threshold compatible with a net-zero grid by 2035).

- Stationary electricity storage systems that do not use fossil fuels in operation, such as batteries, pumped hydroelectric storage and compressed air storage.

- Equipment for the transmission of electricity between provinces and territories.

The CEI Tax Credit will be available as of Budget Day 2024 in respect of projects that commenced construction on or after Budget Day (March 28th, 2023). The CEI Tax Credit will not be available after 2034. To claim the CEI Tax Credit, certain labour and other conditions must be met to be eligible for the maximum rate, otherwise, a reduced rate will apply. Budget 2023 also states that the Department of Finance is engaging with provinces, territories, and other relevant parties to develop the design and implementation details of the tax credit.

Image Source: Getty Images via Canva

Clean Technology Investment Tax Credit (CTI)

The Clean Technology Investment Tax Credit (previously announced in the Budget 2022 Fall Economic Statement) is a 30% refundable tax credit available in respect of the capital costs of investment in eligible property/equipment used to support Canadian companies adopting clean technologies. The CTI Tax Credit is applicable to investments in eligible property that is acquired and becomes available for use (in accordance with the available-for-use rules applicable to depreciable property) in Canada on or after Budget Day (March 28th, 2023).

Eligible Equipment (Previously Announced):

- Electricity generation systems, including solar photovoltaic, small modular nuclear reactors, concentrated solar, wind and water (small hydro, run-of-river, wave and tidal) (Described under CCA Class 43.1).

- Stationary electricity storage systems that do not use fossil fuels in their operation, including but not limited to batteries, flywheels, supercapacitors, magnetic energy storage, compressed air storage, pumped hydro storage, gravity energy storage and thermal energy storage (Described under CCA Class 43.1);

- Low-carbon heat equipment, including active solar heating, air-source heat pumps and ground-source heat pumps (Described under CCA Class 43.1);

- Equipment to generate heat or electricity from concentrated solar energy;

- Equipment to generate heat or electricity from small modular nuclear reactors; and

- Industrial zero-emission vehicles and related charging or refueling equipment, such as hydrogen or electric heavy-duty equipment used in mining or construction (Described in Class 56 (e.g. hydrogen or electric heavy-duty equipment used in mining or construction) and charging or refueling equipment described under CCA Class 43.1 or CCA Class 43.2 that is used primarily for such vehicles.

Budget 2023 expanded the eligibility for the CTI Tax Credit to include geothermal equipment eligible for capital cost allowance under Classes 43.1. and 43.2. Eligible geothermal properties include equipment used primarily for the purpose of generating electrical energy or heat energy, or both, solely from geothermal energy; may include piping, pumps, heat exchangers, steam separators and electrical generating equipment.

Find about more about the Classes of depreciable property here.

The CTI Tax Credit becomes available for use on Budget Day (March 28th, 2023) and will be phased out starting in 2034, and eliminated after 2034. The CTI Tax Credit will be dependent on the satisfaction of labour conditions concerning prevailing wage requirements, and apprenticeship requirements. The tax credit rate is proposed to be reduced to 20% if the labour conditions are not satisfied.

Clean Technology Manufacturing Tax Credit (CTM)

While the Clean Technology Investment Tax Credit, first announced in Budget 2022, will provide support to Canadian companies adopting clean technologies, Budget 2023 introduces a 30% refundable credit for manufacturing. The Clean Technology Manufacturing Investment Tax Credit will provide support to Canadian companies that are manufacturing or processing clean technologies and their precursors.

The CTM Tax Credit will be a refundable tax credit for investments in machinery and equipment used for clean technology manufacturing and processing, or investments in critical mineral extraction and processing. It will be equal to 30% of the capital cost of “eligible property” that is associated with “eligible activities” and that is acquired and becomes available for use on or after January 1, 2024.

Eligible Property

The CTM Tax Credit will be available in respect of certain depreciable property that is used all or substantially all for eligible activities. Eligible property would generally include machinery and equipment, including certain industrial vehicles, used in manufacturing, processing, or critical mineral extraction, as well as related control systems. If the property becomes subject to a change in use, or is sold, within a certain (unspecified) period of time, a portion of the CTM Tax Credit will be clawed back.

Eligible activities include:

- Manufacturing of:

- Renewable energy equipment (i.e., solar, wind, geothermal),

- Nuclear energy equipment,

- Grid-scale electrical storage equipment,

- Zero-emission vehicles,

- Batteries, fuel cells, recharging systems for vehicles, and

- Hydrogen production equipment (among other things); and

- Upstream components, sub-assemblies and materials that are purpose built for or “designed exclusively to be integral to” eligible clean technology manufacturing and processing activities.

- Processing and recycling of nuclear fuels and heavy water; and

- Extraction and processing activities related to critical minerals for clean technology such as lithium, cobalt, nickel, graphite, copper and rare earth elements.

The CTM Tax Credit will apply to property investments that are made and become available for use after January 1st, 2024 (to be gradually phased out starting in 2032, and eliminated after 2034).

Clean Hydrogen Investment Tax Credit (CH)

A refundable tax credit for the capital cost of projects that produce clean hydrogen. First introduced in the 2022 Fall Economic Statement, Budget 2023 expands on the CH Tax Credit. The CH Tax Credit is available in respect of projects where hydrogen is the only byproduct of the production process or makes up substantially all of the byproducts of the production process.

The CH Tax Credit will be available in respect of the cost of purchasing and installing “eligible equipment” acquired for a project producing hydrogen, either through electrolysis or from natural gas (provided CO2 emissions are abated through CCUS – excluding equipment already described in Class 57 or Class 58 which is eligible for the CCUS Tax Credit) in addition to certain equipment for hydrogen compression and on-site storage.

Note: Expenses incurred in the development of a hydrogen project that do not relate to the acquisition or installation of equipment (e.g., feasibility studies, front-end engineering design studies and operating expenses) do not qualify for the CH Tax Credit.

The CH Tax credit can be claimed at various rates (15-40%) depending on the assessed carbon intensity (CI) of the hydrogen that is produced (measured in kg of carbon dioxide equivalent per kg of hydrogen). Refer to the table below.

Proposed tax credit incentive structure for clean hydrogen production | |

Carbon Intensity Tiers¹ | Tax Credit Rate² (applied to eligible costs) |

<0.75 kg | 40% |

0.75 kg to <2.0 kg | 25% |

2.0 kg to <4 kg | 15% |

4 kg or higher | N/A |

¹Reflects the expected life-cycle emissions of a project based on its carbon intensity (measured as kilograms (kg) of carbon dioxide equivalent per kg of hydrogen produced). ²Assumes labour requirements are met. | |

(Source: Table 3.1: Proposed tax credit incentive structure for clean hydrogen production)

The carbon intensity of a project is assessed according to standards set by Environment and Climate Change Canada and verified by the federal government (with ongoing annual verification requirements). To receive the CH Tax Credit, Budget 2023 requires the completion of an initial hydrogen production design study, which will be used to assess the CI levels. The CH Tax Credit is subject to a clawback based on the actual carbon intensity of the hydrogen produced by the project, determined by subsequent assessment of the project after operations commence.

The CH Tax Credit becomes available for use on or after 2023 Budget Day in Canada (with a transitional phase-out in 2034). Similar to the implementation of the other tax credits, the CH Tax Credit will be dependent on the satisfaction of labour conditions concerning prevailing wage requirements and apprenticeship requirements. The tax credit rate for each tier is proposed to be reduced by 10% if the labour conditions are not satisfied.

Carbon Capture, Utilization, and Storage Investment Tax Credit (CCUS)

Budget 2023, expands on the CCUS Tax Credit, previously released in 2022, to include additional types of equipment used to capture carbon dioxide emissions for storage or other uses in industrial processes.

The CCUS Tax Credit now includes:

- Geological storage in British Columbia (in addition to Alberta and Saskatchewan);

- Dual-use equipment that produces heat and/or power, or uses water used for CCUS (with the ITC to be pro-rated); and

- Refurbishment costs incurred after completion of a project.

The CCUS Tax Credit is available in respect of eligible expenses incurred after January 1, 2022. Additionally, similar to certain other CITCs, the government intends to apply labour requirements to the CCUS Tax Credit, with details to be announced at a later date.

Other Requirements

To be eligible for the credit, however, the project must meet certain criteria outlined by the CRA. The project must be located in Canada and generate clean energy for use in Canada. Eligible costs for the credit include both capital expenses and operating and maintenance expenses incurred in relation to the project. Budget 2023 indicates that in the case a business may be eligible for multiple CITCS, they may only claim one such credit.

Labour Requirements

Each of the Hydrogen Credit, Technology Credit and Electricity Credit contains labour requirements that must be satisfied to obtain the full amount of the respective credit. These labour requirements are split into two categories:

Prevailing Wage Requirement. Requires that all covered workers are compensated at a level that meets or exceeds the relevant wage, plus substantially similar monetary benefits and pension contributions, as specified in an eligible collective agreement. It is anticipated that the calculation of a prevailing wage will cause interpretative uncertainty.

Apprenticeship Requirement. Requires that, in a given taxation year, not less than 10% of the total labour hours performed by covered workers be performed by registered apprentices.

The labour requirements will apply to workers engaged in projects that are subsidized by the respective investment tax credit and workers whose duties are primarily manual or physical in nature. The labour requirements will not apply to workers whose duties are primarily administrative, clerical, supervisory or executive in nature.

What Does This Means for Canadian Businesses

These Clean Investment Tax Credits, which total over $60 billion over the coming ten years, will support green innovation in the private sector, grow our economy, and create or secure thousands of good middle-class jobs. The Canadian Climate Institute estimates that the Clean Electricity Investment (CEI) Tax Credit alone (estimated value of $25.7 Billlion) will dramatically support the provinces transition away from emissions intensive grids – namely the prairie provinces relative to their existing grid infrastructure.

Source: Canadian Climate Institute (CIC)

The Clean Investment Tax Credits are just one of several government initiatives aimed at promoting clean energy and reducing greenhouse gas emissions in Canada. Other programs include grants for renewable energy projects and incentives for purchasing electric vehicles. These efforts are crucial in combating climate change and moving towards a sustainable future for Canada and the world at large.

Additional information about these investment tax credits can be found here.

Original Story References:

2023 Canadian Federal Budget Commentary – Clean Energy and Tax Incentives

2023 Canadian Federal Budget: Clean energy | Global law firm | Norton Rose Fulbright

2023 Federal Budget: Green-Energy Tax Incentives | Blakes

News release: 2023 Federal Budget ushers in new era for Canadian renewables

Canada – Corporate – Tax credits and incentives

EY Tax Alert 2023 no 20 – Federal budget 2023–24 | EY Canada

Classes of Depreciable Property Canada

Technical Guide to Class 43.1. and 43.2.

Schedule II Capital Cost Allowances

Four Conditions for the new Clean Electricity Investment Tax Credit